One problem, of many, entrepreneurs struggle with is finding the right investor. A partnership with a venture capital firm could be a life-long commitment and a determining factor in how successful a business would become. Inc.com outlined 5 parameters to look for when finding the right capital firm investor: Geography, Sector, Conflict, Birds vs. Turtles, and Fund and Check-size. In this article, we discuss these steps, and how Jumpstart Foundry checks all the boxes for the entrepreneur looking to make strides in the healthcare industry with a seed-stage investment.

“Network. Credibility. Knowledge. Guidance. That’s what entrepreneurs should be looking for in their investors. ”

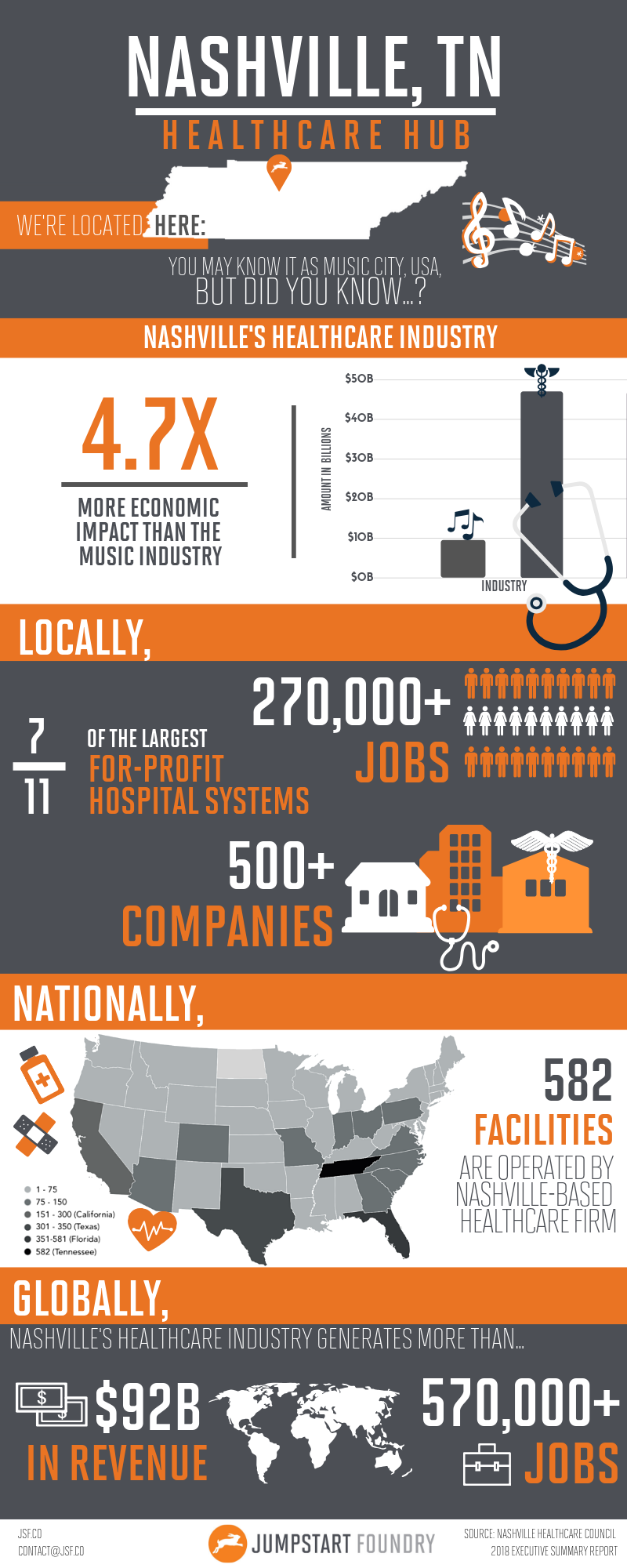

1. Geography –Where the firm is located has influence on its connections, industry focus, networks, and often check size.

The Healthcare Industry in Nashville is booming. According to the Nashville Healthcare Council, the Nashville Healthcare Industry contributes an overall economic benefit of $46.7 billion and more than 270,000 jobs to the local economy annually. Globally, it generates more than $92 billion in revenue and more than 570,000 jobs. This is why even though your startup may not have a physical presence here in Nashville, having a healthcare venture capital firm as well-positioned as Jumpstart Foundry, could go a long way to give your business the competitive advantage it deserves.

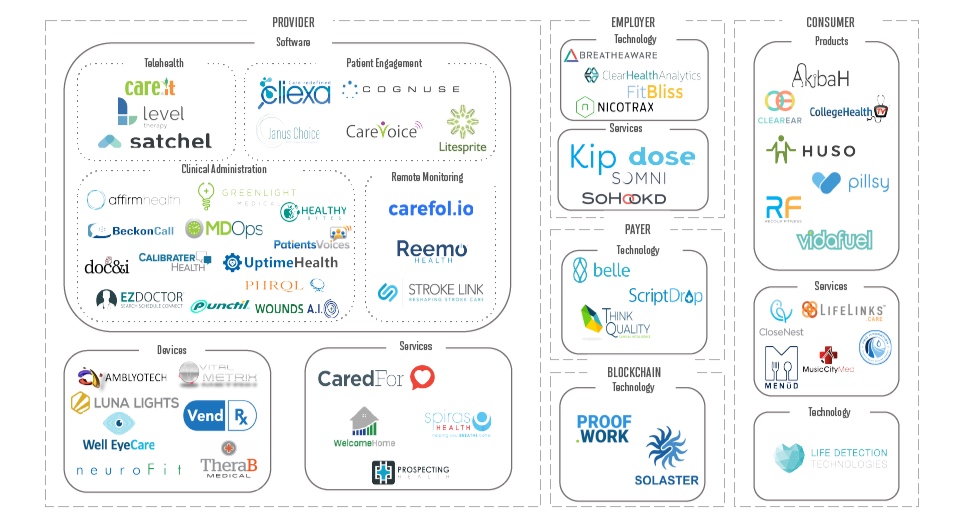

2. Sector – Inc encourages entrepreneurs to look for investors with experience specific to their industry their startup hopes to break into. We at Jumpstart Foundry specialize in the healthcare industry exclusively. We have a rich list of investors, and continue to partner with leaders in healthcare. This helps us to place our portfolio companies at the forefront of the marketplace, together with our knowledge and experience in the industry.

3. Conflict— We are cognizant of not investing in companies that are direct competitors. This is because we take an active role in helping Founders get-to-market, find customers and win marketshare. While the specific industry segments our companies serve may overlap and have similar ICPs (ideal customer profiles), we will never promote direct competition between them.

4. A Bird fund vs. Turtles fund— Inc linked an article by Subtraction Capital which describes a ‘Bird fund’ as a company that will be very involved with actively helping the startups they invest in, by helping them make meaningful connections through their partners, industry experts, and prospective clients or customers. A ‘Turtle fund,’ on the other hand, is more hands-off. Jumpstart Foundry is a “Bird Fund.” We operate at scale— making 15-20 investments every year while also providing strategic help. Our portfolio companies are entitled to office hours with Industry Experts, face time with leaders in the Healthcare Industry, and strategic capital – the right help at the right time from a team you can count on.

5. Fund and check-size— When finding an investor, it’s important to consider the firm’s specialty— some firms focus on Series A, some only write checks at $20M or more. We believe in focusing in on one thing. For us, that’s seed-stage investments in healthcare companies. We make investments with standard terms for all companies: $150,000 SAFE (simple agreement for future equity) with a $2M or $4M valuation cap, in exchange for a one-time $50k membership fee for our value-added services.

The post was originally published at www.inc.com as, “5 Steps to Finding the Right Venture Capital Investor | Bubba Page | Outro.”