Traditional venture capitalism fails to consistently deliver risk-adjusted returns. They all have the same strategy of taking shots in the dark, basing investments on gut feelings or relying on personal relationships for deal-flow.

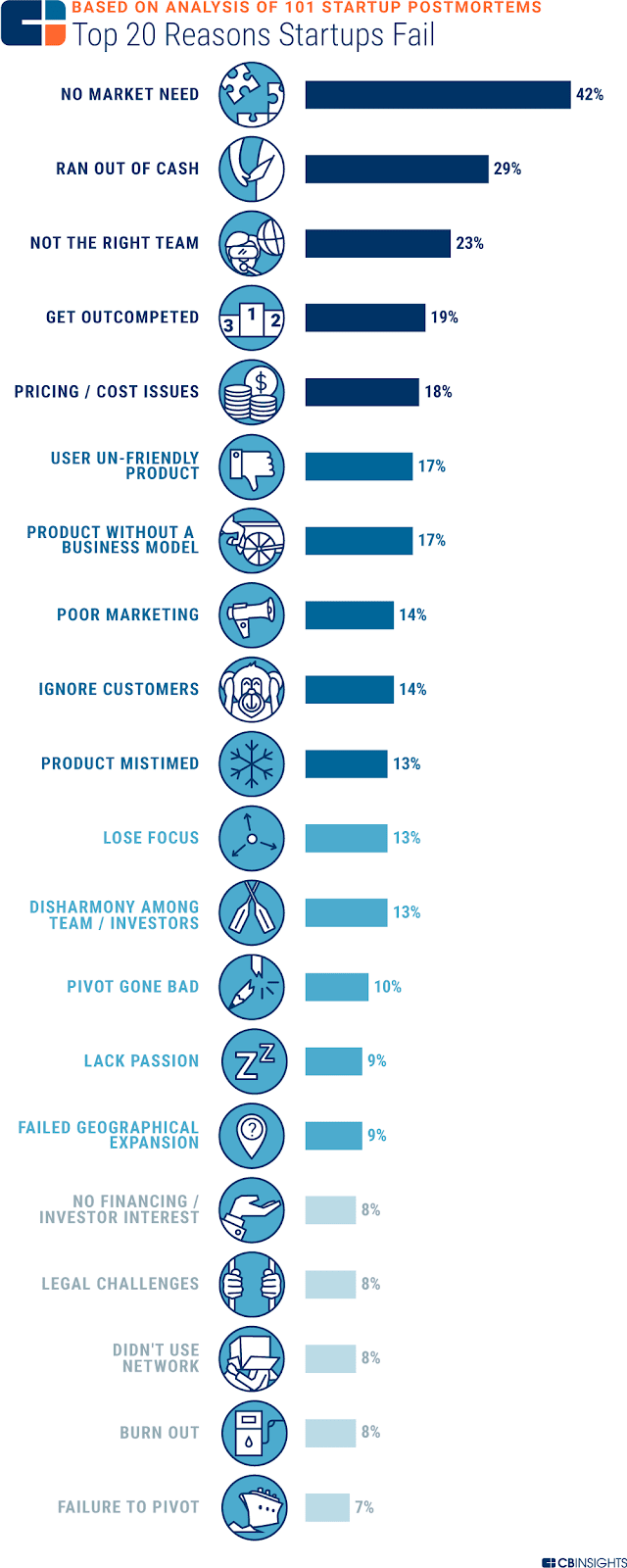

Success for a venture capital firm is contingent on its investment’s success (i.e. exit, acquisition). So, how come most startups fail? Lack of product/market need! If the success of a VC firm is based on the success of the startup, its quite important that market necessity is top of mind. So we’ll start there:

Venture Capitalism 2.0

– A deep network with access to specific needs, priorities and critical timing of key trends: a seat at your own table!

– The ability to leverage proprietary and third-party market data to develop investment insights and theses

– Scaling investment theses via supply and demand mining and algorithms/modeling

– Matchmaking explicit potential buyer and investor priorities with investments

– Optimized for maximum hit rate

– Industry expertise and mentoring opportunities

– Predictable, reliable & diversified system to deliver successful outcomes at 2-4x industry norm

What Was Traditional Venture Capital Like?

1. Hoping to find home-run deals

2. Accepting a very low hit rate

3. Crossing fingers all day, everyday

That’s why we wanted Jumpstart to be different, and better.

Five years ago, we dug into the data of startup failure. Specifically, we researched the cause of death of over 350 venture-funded healthcare startups over a 17 year period. We wanted to clearly define the most damaging risk factors and learn the root cause of what makes launching a new innovation so challenging.

What did we discover?

A lack of product-market fit.

Lo and behold… (one of) the reasons Jumpstart Foundry was founded!

A new and better type of investment business with new processes and technology for harnessing innovation and collecting information to leverage a network built specifically to provide competitive advantages—all to drive investment success!

* Breathes heavily *

The power of the network we have built and the proprietary data we have compiled leads to unmatched results. Check it out:

-

over 50% success rate and stronger financial returns than conventional/traditional VC

-

advantages in every phase of growth from startup to maturity and exit

-

systematic and repeatable with no single point of failure

-

provides insight into the origins of innovation and uncovers where great ideas are forming

Jumpstart’s model is designed to capture value from and accelerate meaningful change in industries undergoing massive shifts. Our focus is healthcare, and we believe it will provide the biggest and best opportunity in the next 5 – 10 years.

Each year, we invest in 15-20 high-quality, seed and growth stage healthcare companies. Then we jump in and help them succeed. Check out our portfolio companies for tax!