Direct-To-Consumer, or DTC in short, are products or services that are financed, designed, produced, marketed, distributed and sold by the same company.

They bypass the middleman and connect directly to consumers. By avoiding retail markup, it’s an attractive business model and a wave of DTC companies began.

Source: IAB

Direct-to-Consumer ventures are making it harder for Audiologists and Optometrists to stay in business. A large portion of Audiologist and Optometrist’s revenue comes from selling product (hearing aids, glasses and contact lenses etc). Last week, we identified the 8 market forces leading to the rise of direct-to-consumer models in healthcare. You can view that article here.

Below are a couple of ventures allowing consumers to bypass the Audiologist and Optometrist, concluding with a Jumpstart Foundry company that successfully exited to Johnson & Johnson Vision.

Hearing:

Audicus: Based in New York, NY and founded in 2010, Audicus send hearing aids directly to consumers. Audius allows users to send them the results of their clinical hearing test or take a quick 15 minutes hearing test and order the appropriate hearing aid directly from their site. Audicus allows users to purchase their hearing aid, the “Audicus Clara, for a one time price of $699 or a monthly payment plan. Audicus has raised a bit over $4M at a post-money valuation slightly over $14M according to Pitchbook.

Lively: Founded in 2018 and based in New York, NY, Lively was spun out of venture studio Redesign Health. Lively has patients take a hearing test on their platform, ships a patient’s hearing aids to them within three days, and provides on demand physician support after delivery. Lively claims their hearing aids works for 85% of those who have hearing issues. Lively’s hearing aids cost $2,350 or $98 a month for 24 months. Lively raised $16M in early 2019 at a post money valuation of nearly $41M.

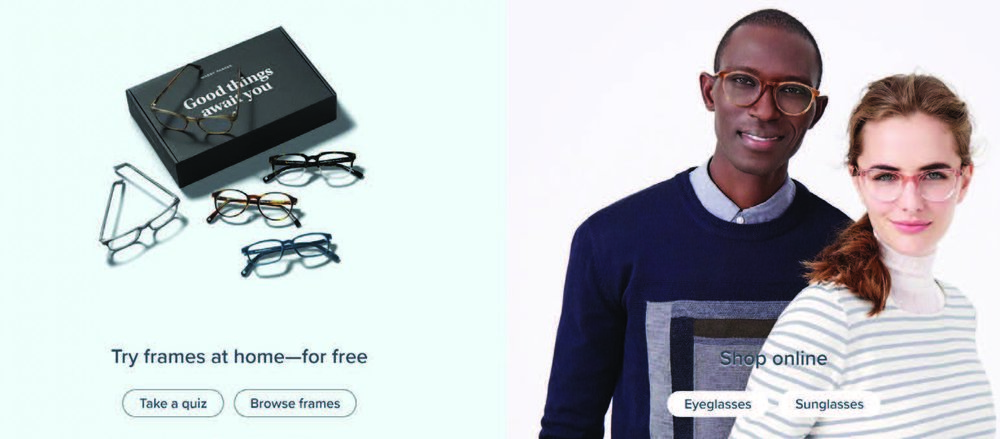

Warby Parker: Founded in 2010 and based in New York, NY, Warby Parker has created a platform that allows consumers to purchase eyewear at a lower price point than going through an optometrist. Warby Parker sends consumers five different frames at once for them to try on to see what works best for them and also has retail locations across the United States. Warby Parker has raised over $290M at a post-money valuation of $1.75B according to Pitchbook.

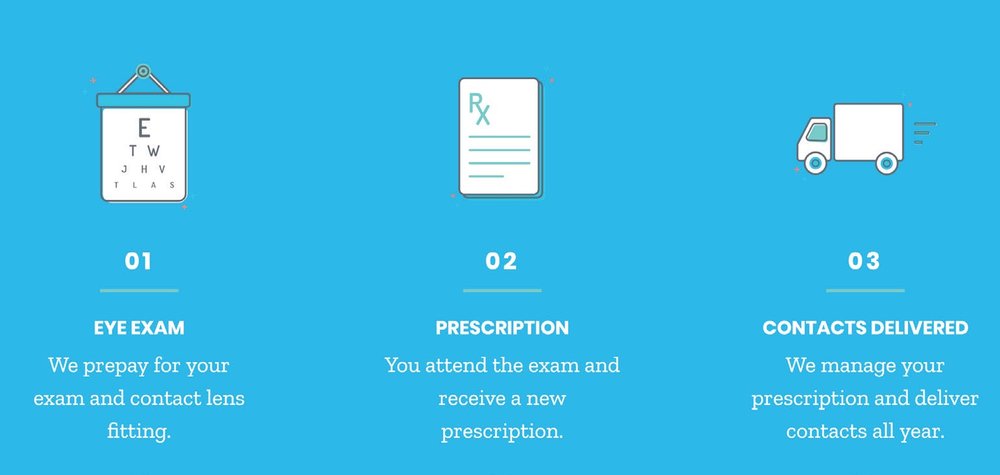

Sightbox: Founded in 2014 and based in Portland, OR Sightbox allows for users to obtain a prescription for contact lenses and then arranges for a yearly supply to be delivered to the consumer’s residence. They support the delivery of all major brands of contacts and simplify the pricing structure to provide consumers with a transparent, low price for their yearly supply. Sightbox was acquired by Johnson & Johnson Vision Care in 2017.

This blog post is an expert from a full-length, “Bridging Treatment Gaps Through the Direct-to-Consumer Model.” You can download the report here.