Health Savings Accounts

Health Saving Accounts (HSAs) are savings accounts that allow users to set aside pre-tax income to pay for qualified medical bills and save for future medical expenses. Qualified medical expenses include hospital care, primary care visits, and psychological counseling among other expenses but do not include cosmetic surgery or nutritional supplements.

In addition to paying for qualified medical expenses, the money in HSA accounts can be used to invest in stocks, bonds, and mutual funds. According to Devenir, there were nearly $66B worth of assets in HSAs in 2019, up from $53.8B in 2018. At the end of 2019, there were 28.3M HSA accounts, up from 25.08M at the end of 2018. 3 Spurring this growth in HSA assets are the “triple tax benefits” that these savings accounts offer users. “Triple tax benefits” mean that: 1) funds in HSAs are federally tax deductible, 2) the earnings and interest gained from HSA funds are tax deferred and, 3) users do not have to pay to withdraw funds from the HSA.

To qualify for an HSA, a consumer must be enrolled in an eligible high deductible health plan (HDHP). An eligible HDHP is one that only covers select preventive care services before the deductible is met and meets the following deductible and out of pocket criteria: For an individual, the deductible must be at least $1,400 and the out of pocket maximum cannot be more than $6,900. For a family, the deductible must be at least $2,800 and the out of pocket maximum cannot be more than $13,800. Additionally, an individual and a family can only contribute a limited amount to an HSA each year. For an individual, the limit is $3,550 in 2020. For a family, the limit is $7,100 in 2020.

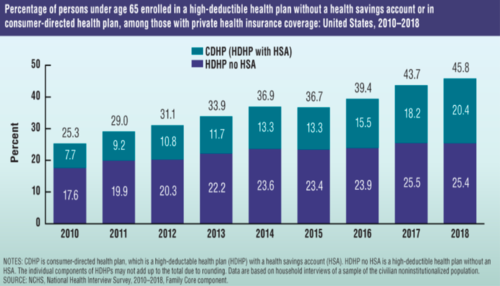

Figure 1: According to the CDC, HDHPs with an HSA account for over 20% of the market. 6

Enrollment in HSA-Eligible health plans has grown steadily over the last eight years, as can be seen in Figure 1.

According to the CDC, about 44% of those with a HDHP and 20.4% of the total market are enrolled in an HSA-eligible HDHP. While enrollment in HSAs is fairly high, optimal use of HSAs is low. For example, only 14% of accounts contributed the full amount to their HSA in 2018. Additionally, 37% of HSAs did not receive any contributions in 2018, and only 5% of HSA users have invested assets outside of cash in their account. This is non-optimal because using HSA funds on medical expenses towards a deductible effectively reduces a consumer’s out of pocket costs as the funds used were put into the HSA tax-free.

A few challenges prevent the optimal use of HSAs. First, there is a high degree of confusion about the benefits an HSA provides to users. For example, according to a survey conducted through Fidelity, 62% of participants surveyed falsely believed they would lose any unspent money in their HSA at the end of the year. 8 This may be the result of many users getting HSAs confused with Flexible Spending Accounts (FSAs) in which pre tax money can be put in the account but that results in unused funds at the end of the year being forfeited.

Second, there are usually fees that reduce the financial advantages if the HSA is primarily used by the consumer as a spending account. For example, some HSAs charge up to $5 a month in maintenance fees, and can charge even more for paper statements and debit cards. These fees can significantly reduce the advantages of the tax breaks from an HSA for a consumer. For example, if an individual is making 50K in New York without an HSA , they would pay $4,342 in federal taxes. If they instead put 1K directly in their HSA, they would only pay $4,222 in federal taxes for a savings of $120. If the HSA had $5 in maintenance fees, 50% of those savings would be lost to fees. This can make signing up for an HSA seem like a poor investment of time.

Third, is the lack of account flexibility. For example, as mentioned above, 37% of HSAs did not receive contributions. Because of the 20% tax penalties in addition to regular income tax for withdrawing capital that does not get spent on qualified medical expenses, people without enough financial flexibility may not want to risk putting money in an HSA that they may need later. To encourage even small investment, an HSA needs to indicate that they can do more to stretch the dollar for the user to compensate for the inflexibility of the HSA funds.

Below are startups working to alleviate these challenges of traditional HSAs by providing clarity around benefits, reducing fees, and lowering costs of healthcare services and products for their users.

First Dollar: First Dollar is building an HSA that not only does not have monthly fees, but also uses its user base size to create healthcare service and product discounts for their users.

Lively Health: Lively Health has built an HSA focused on streamlining the enrollment process for users, making it easy for individuals to easily roll over accounts from other HSAs and quickly onboard themselves.

Starship: Starship is making it easy for users to use their HSA as a hands on investment vehicle, focusing on allowing users to easily begin investing their savings through their HSAs.

Bend: Bend has created a no monthly fee HSA. Bend makes it easy for people to learn how to maximize their HSA by teaching people which of their personal costs could have been paid for out of their HSA.

Amino: Amino has created a platform to guide people to cost conscious care providers. Additionally, they have created an HSA for people using Amino, thereby enabling them to get the most out of their HSA contributions.

Salusion: Salusion is creating a consumer friendly HSA that makes it easy for consumers to take full advantage of their HSA contributions.

Investment Recommendation: Buy

Enrollment in HSA-eligible health plans should continue to rise as the gap in deductibles between PPO plans and HDHP continues to decrease as shown below in Figure 2.

Figure 2: The difference between HDHP and PPO deductibles has been narrowing over the last ten years.

Figure 2: The difference between HDHP and PPO deductibles has been narrowing over the last ten years.

Currently, HSAs are mostly being used as spending accounts and not as long-term savings accounts. For example, according to a report by Lively, 96% of HSA fund yearly contributions are being spent on medical expenses. Additionally, EBRI reports only 5% of HSAs have invested assets. This is indicative of consumers utilizing HSAs as “spending accounts” due to their tax breaks rather than as an investment vehicle. Therefore, the more successful HSAs will be ones with consumer cost guidance value propositions instead of long term financial gain value propositions.

For example, Starship is taking a financial gain approach in which they are trying to make it easy for consumers to invest in mutual funds, bonds, and stocks through their HSA. First Dollar is instead enabling consumers to get lower priced health care services and products. For example, they are offering a pharmacy discount benefit to their users, enabling them to drop their yearly prescription costs. The data mentioned above seems to indicate that the cost savings benefit as opposed to long term investment gains is what consumers currently care more about.

Additionally, HSAs are only being marketed to individuals and employers. Going through hospitals as a go-to market strategy seems like an overlooked yet viable strategy. By integrating with insurance verification eligibility software, HSAs could allow for hospitals to enroll patients in an HSA pre-treatment. Therefore patients would benefit by having their subsequent costs be tax-deductible and hospitals would benefit as the patients become more likely to pay their out of pocket balance as every dollar they spend on the bill is reimbursable. For example, a patient has a $3,000 out of pocket bill and pays 12% federal income tax. By paying for that through the HSA they enrolled in at the hospital, every dollar is tax reimbursable, saving the patient potentially $360.

Works Cited

- Health Savings Account (HSA). healthcare.gov https://www.healthcare.gov/glossary/health-savings-account-hsa/

- About Publication 502, Medical and Dental Expenses. IRS. https://www.irs.gov/forms-pubs/about-publication-502

- Devenir Research 2019 Year-End HSA Market Statistics & Trends Executive Summary. Devenir. https://www.devenir.com/wp-content/uploads/2019-Year-End-Devenir-HSA-Research-Report-Executive-Summary.pdf

- Publication 969 (2019), Health Savings Accounts and Other Tax-Favored Health Plans. IRS. https://www.irs.gov/publications/p969

- UnitedHealthCare 2020 HSA Guidelines. https://www.uhc.com/content/dam/uhcdotcom/en/HealthReform/PDF/Provisions/reform-hsa-external-flier-guidelines.pdf

- NCHS Health Insurance Data. CDC. https://www.cdc.gov/nchs/about/factsheets/factsheet_NCHS_health_insurance_data.htm

- Health Savings Account Balances, Contributions, Distributions, and Other Vital Statistics, 2018: Statistics From the EBRI HSA Database. EBRI. https://www.ebri.org/content/health-savings-account-balances-contributions-distributions-and-other-vital-statistics-2018-statistics-from-the-ebri-hsa-database

- Challenging common misconceptions about HSAs. Fidelity. https://sponsor.fidelity.com/pspublic/pca/psw/public/library/engageemployees/misconceptions_hsa.html

- Using a Flexible Spending Account (FSA). Healthcare.gov. https://www.healthcare.gov/have-job-based-coverage/flexible-spending-accounts/

- Interest rates and fees. Optum Bank. https://www.optumbank.com/all-products/hsa/rates-fees.html

- Federal Income Tax Calculator. SmartAsset. https://smartasset.com/taxes/income-taxes#7sACwhtKoy

- Fronstin, P., Enrollment in HSA-Eligible Health Plans: Slow and Steady Growth Continued Into 2018. EBRI Issue Brief, no. 478 (Employee Benefit Research Institute, March 28, 2019). https://www.ebri.org/docs/default-source/ebri-issue-brief/ebri_ib_478_hsaenrollment-28mar19.pdf?sfvrsn=e86b3f2f_4

- Kaiser Family Foundation. Employer Health Benefits 2017. http://files.kff.org/attachment/Report-Employer-Health-Benefits-Annual-Survey-2017

- 2019 HSA Spend Report. Lively. https://assets.ctfassets.net/6j8y907dne6i/24FtkeLryUrkrbHg3dvAsZ/262d52e2c5230252e3c7ec07b8ee3ff4/2019_HSA_Spend_Report.pdf