The United States is home to 325 million people; each generation has different care preferences and needs. Is our healthcare system prepared to best accomodate each group?

Our sister company and Growth Fund, Jumpstart Capital (JSC), wrapped up a successful quarter both on fundraising and investment fronts. In their Q3 Newsletter, JSC discusses how recent healthcare trends and headlines affect the shifting generations. You will also find a recap of Health:Further, new investments, and a look at the Ambulatory Surgery Center (ASC) market. (You can read the full newsletter here).

Let’s dive into Q3’s most discussed healthcare trends and news stories through the lens of the generations, as viewed by JSC.

Q3 was yet another time of change in our industry; and change is accelerating given key drivers in demographics, technology, regulation and new market entrants, primarily from the tech and retail sectors.

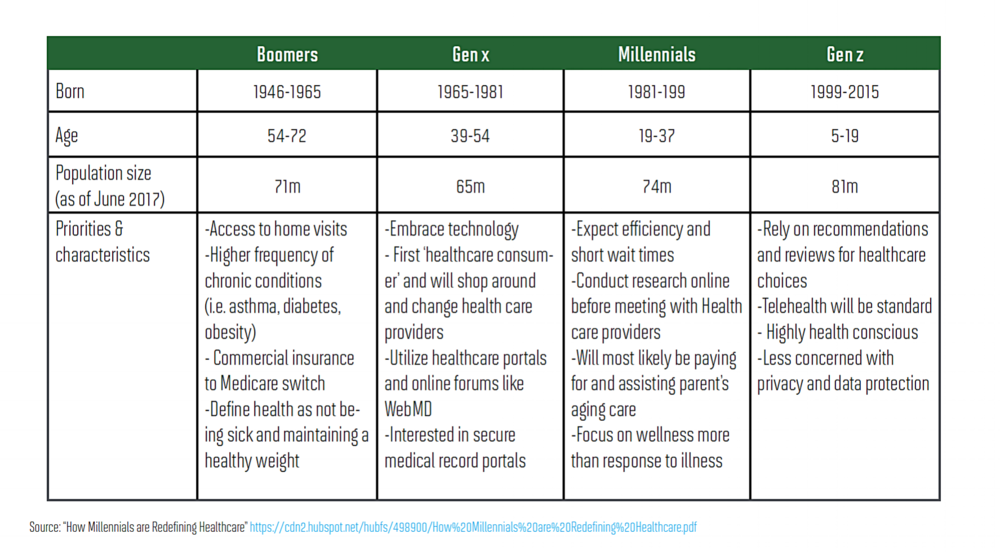

A significant driver in the industry is generational / demographic change. The Baby Boomers remain a spending and behavioral force; Millennials hold unique beliefs and expectations; and Generation Z is expected to be as uniquely defined as the prior generations.

Below are examples of beliefs and priorities through the lens of each generation:

Source: Erieinsurance.

In technology, telehealth has moved significantly into the foreground. In July, the Centers for Medicaid and Medicare Services (CMS) proposed changes to telehealth billing. The change would allow reimbursement for primary clinicians and clinical liaisons to adopt telemedicine into their workflows. Marrying telehealth with lower-level care providers as preventative care influencers may help manage higher patient volumes at a lower cost. Examples of telehealth going mainstream include:

• CVS offering telehealth visits via smart phones at a flat rate of $59

• Comcast offering “Doctor on Demand” telehealth services to its employees

• Oscar, a new brand of commercial insurance focuses on high-quality experience and use of technology. Oscar uses telemedicine functions and integration with multiple lines of wearables. Oscar has continued to see growth and rounds of venture funding, having recently secured $375 million from Alphabet, in part, to accelerate its entrance into Medicare Advantage programs.

The entrance of retail companies into the health space is remarkable. For example, Best Buy made an acquisition of a connected health and emergency response service serving more than 900,000 paying subscribers in the eldercare market.

Last quarter we visited the status of multiple M&As and alliances. This quarter saw more activity:

• Cigna shareholders approved the acquisition of Express Scripts, which comes as a major rival to CVS Health and Aetna merger

• Walmart partnered with health insurer Anthem to expand access to over-the-counter medications for seniors starting January 2019

• Amazon announced Dr. Atul Gawande as the CEO of the Amazon-Berkshire-JPMorgan Chase healthcare initiative

• Amazon purchased Pillpack, a direct-to-consumer pharmacy service, for just under $1B, silencing speculation about Amazon’s entrance into the pharmacy space. Walgreens, RiteAid, and CVS’s stocks plummeted nearly $20b on the news.

The above are only a few examples of the current speed of change in the healthcare industry–and from where changes emanate…

The post was originally published at www.jscap.co as, “Q3 2018: WRAPPING UP FUNDRAISING, BUILDING THE PORTFOLIO, AND DOUBLING DOWN ON OUR INVESTMENT THESIS.”